Even five years after it was passed into law, the Affordable Care Act (ACA) continues to be one of the top concerns for employers – and for good reason. The ACA is one of the most comprehensive laws impacting employee benefits in decades. In this article, we provide a few tips that should help you prepare for the new reporting requirements with Sage HRMS.

Learn Your Compliance Basics

One of the most important things you can do is learn the ACA compliance basics. Getting a feel for employee thresholds, required forms, and reporting deadlines can help you avoid costly mistakes and fines.

In a nutshell, the ACA requires that all businesses with 50 or more full-time equivalent employees (FTE) provide health insurance to at least 95% of their FTEs (and dependents up to age 26), or pay a fee.

This article posted on the Society for Human Resource Management (SHRM) provides a nice overview of the reporting requirements and tips for what’s ahead in 2016.

Information Reporting Deadlines

In recent months, the IRS extended the due dates for ACA information reporting as follows:

- Forms 1095-B and 1095-C

March 31, 2016 (previous deadline was February 1, 2016) - Forms 1094-B, 1095-B, 1094-B, and 1095-C filing on paper

May 31, 2016 (previous deadline was February 29, 2016) - Forms 1094-B, 1095-B, 1094-B, & 1095-C filing electronically

June 30, 2016 (previous deadline was March 31, 2016)

Am I Subject to ACA Requirements?

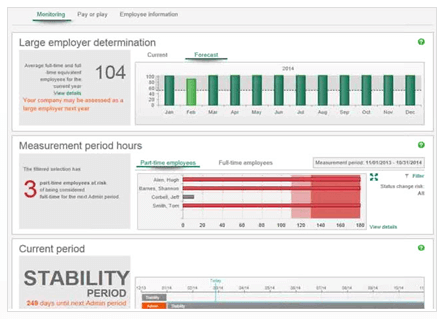

With all the confusion surrounding the new law, you may be struggling to fully understand how the ACA affects you, your employees, and your business. That’s where My Workforce Analyzer might help. This add-on component for Sage HRMS tracks and analyzes the HR data that’s already in your system to help you make informed decisions regarding employee healthcare and ACA requirements.

This unique tool works by monitoring your employee hours and coverage to help you determine if you qualify as a large employer, and what your obligations are under the ACA.

Pay or Play

In some cases, employers who are required to provide employee health coverage under ACA requirements might instead opt to pay the fine for noncompliance if it’s more cost effective to do so. The interactive dashboards and analytics of My Workforce Analyzer help you evaluate this “Pay or Play” option and make an informed decision.

Stop the Struggle

If you don’t want to waste another minute struggling to understand the complex ACA requirements and trade-offs, it might be time to take My Workforce Analyzer for a test drive. Contact us if you’d like to schedule a demo.