Top 10 Sales & Use Tax Tips

Debates over online sales tax and related statutory rules and rate changes have vaulted sales and use tax compliance to the top of every savvy businessperson’s action list. Understanding how to implement safeguards and systems, monitor widely varying statutory rules, and find efficient ways to collect and remit the right sales and use tax to the right jurisdiction at the right time, can baffle even the most compliance-minded businessperson.

Developed by Avalara tax experts, the following top ten sales and use tax tips will help your business develop an effective proactive sales tax strategy long before the auditor knocks on your door. These tips are a starting point to address sales and use tax compliance for your business.

1. Don’t underestimate sales tax complexity

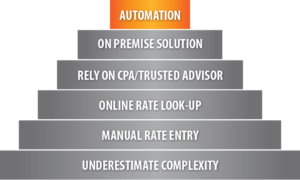

Stages to sales tax automation

Plenty of businesses incorrectly assume they have sales and use tax handled because their sales tax process has worked for them in the past—and as a result have incurred penalties and fines. However, as a business grows its sales tax obligations become more difficult to manage effectively. Some activities that increase the difficulty of complying with changing sales tax rules include:

- Selling into new states

- Selling over the Web

- Selling new products or services

- Deploying new ERP or POS software

- Failing to adapt compliance activities to changing rules and regulations

As Congress reconsiders federal legislation to require remote sellers (including online retailers) to collect sales tax, companies might find themselves on the wrong side of an audit notice. Keeping pace with the vast array of tax requirements requires determination, intelligence, and the right tools.

The chart on the right illustrates the process many companies go through before addressing the challenges of sales tax compliance. The truth is many don’t bother addressing it until the auditor appears or the tax notice is received. By underestimating the complexity of sales tax, many companies unwittingly increase their risk of audit. As businesses begin operating in several states, or providing taxable services, or discover through a tax notice that they’ve unknowingly overlooked a tax obligation, they quickly learn that managing sales and use tax compliance is far more complicated than it first appears.

Action Items:

- Assess whether your current systems are properly addressing sales tax complexities. Have you had any negative audit findings, or paid any related fines or fees?

- Follow best practices used by other similarly sized companies. Do they have a system for addressing sales and use tax compliance that you could replicate?

Sample of states that have enacted related rule changes:

Texas, Colorado, Florida, New York, New Jersey

2. Determine tax liability by understanding changing nexus rules

While most business people have some concept of nexus— the connection between a business and a taxing jurisdiction requiring sales tax collection and remittance —many are unaware of dramatic changes to nexus laws happening now. For example, were you aware that many states have passed laws requiring remote sellers to collect sales tax if they get a certain amount of referrals from in-state affiliates? And that Congress passed the Marketplace Fairness Act of 2013, authorizing states to require almost all remote sellers to collect sales tax as long as the states meet certain simplification requirements. This pleases states that have worked at lightning speed over the past few years to implement remote seller sales tax rules, and this is only the tip of the iceberg.

These issues signify intense sales and use tax statutory changes, particularly regarding nexus.

Action Items:

- Review where you currently have nexus and identify applicable rule changes.

- Make sure your business is registered in states where it’s required.

- Determine whether your business might have unknowingly created nexus by engaging contract labor, attending out of region trade shows or other nexus-creating activities.

Sample of states that have enacted related rule changes:

Arizona, California, Pennsylvania, Massachusetts, New Jersey, Michigan, Florida

3. Know which of your products and services are taxable, and where

Once you understand where your company might have created nexus (see tip #2), you’ll want to update sales tax rates for any new products and services to reflect any related jurisdictional changes.

Many states are addressing budget gaps by increasing product and service taxability. The Federation of Tax Administrators surveys states and the approaches they use to tax 185 services. The services are grouped into eight main categories (although each state uses slightly different definitions of what belongs in which category):

- Utilities

- Personal services

- Business services

- Computer services

- Admissions/amusements

- Professional services

- Fabrication repair and installation

Whereas states like Delaware, Hawaii and Washington tax a large number of services, other states such as Alaska, Virginia, and New Hampshire tax very few.

Action Items:

- For each state within which you do business, review any updates to the taxability matrix (generally available on state Department of Revenue sites). Alternatively, subscribe to individual state “tax change notice” email lists.

- Review the Federal Tax Administrators table of states cross-referenced by commonly taxed services (keeping in mind these change often).

Sample of states that have enacted related rule changes:

Wyoming, New York, Missouri, Ohio, Illinois, Wisconsin, Texas

4. Don’t ignore the consumer use tax

Consumer use tax is one of the most common areas in which miscalculated and unpaid tax is found in audits. Use tax is defined as a tax on the use of tangible personal property (TPP) not otherwise subject to sales tax. Generally speaking, a purchaser owes use tax on taxable items purchased on which they paid no sales tax or less tax than the applicable sales tax rate. Unlike sales tax, the remittance responsibility lies with the buyer.

In some cases, the purchaser would be a business, such as a manufacturer or a distributer, buying goods outside the state or online. Use tax must also be paid when a business withdraws goods from inventory for its own use, if sales tax was not paid on those items at the time of purchase. It is the responsibility of a business to selfassess when, and if, use tax is accrued and to pay the state and/or local tax authority on a tax return.

Whereas states like Delaware, Hawaii and Washington tax a large number of services, other states such as Alaska, Virginia, and New Hampshire tax very few.

Action Items:

- Learn the difference between sales and use tax.

- Develop a written use tax policy.

- Review all non-resale purchase invoices and accrue consumer use tax as appropriate.

- Properly track and account for withdrawals from resale inventory.

Sample of states that have enacted related rule changes:

Colorado, Wyoming, New York, Iowa, Texas, Virginia, Ohio, Vermont, Maine, California, Florida

5. Understand changing exemption certificate rules

Tracking and filing exemption certificates, the bugaboo of many well-intentioned business owners, has just gotten more complicated. In 2013, several governors have already proposed plans that would change what their states exempt from sales tax.

Businesses that manage large numbers of exemption certificates often confront a difficult challenge when audited to link specific certificates with specific transactions. In other words, to prove tax was not due on a particular sale. Certificates also expire or may be invalid, potentially leaving the selling business liable for paying uncollected tax.

Action Items:

- Create an audit trail for certificates.

- Update product and service exemption rules in each jurisdiction in which you do business.

- Be able to quickly generate an exemption certificate summary report.

Sample of states that have enacted related rule changes:

Colorado, Minnesota, Maine, California, Louisiana

6. Know when, where, and how to remit sales and use tax returns

Even companies working hard to accurately track and update changes in sales and use tax rules, boundaries, and rate changes often fail to remit their sales tax correctly. Knowing which form to use, where to file, and what to include in your returns can be an onerous task.

Growing companies often struggle to track which tax forms to use in which state, not to mention the varying deadlines and format requirements. Handling this aspect of sales tax compliance particularly given liability issues that might result from doing it incorrectly, creates havoc for many companies.

Action Items:

- Review whether your filing schedule has changed in applicable states.

- Find out whether the states where you have to remit sales tax have implemented new e-filing or pre-payment requirements.

Sample of states that have enacted related rule changes:

Colorado, Florida, Indiana, Maine, Virginia, Washington, Maryland, New York

7. Address compliance red flags relating to tips 1-6

Nexus — Avoid practices that put you at risk for audit: having out-of-date rates and rules, failing to recognize new rules that create remote seller nexus, or using error-prone manual processes to manage unwieldy sales and use tax laws and rates.

Exemption/ reseller certificates — Avoid these exemption certificate-related practices that might increase your risk of an audit: inability to quickly generate a summary report, inaccurate, incomplete and missing certificates, or expired certificates.

Consumer use — Avoid practices that might increase your risk of audit: failing to accrue consumer use tax, using inventory purchased for resale for your company’s own use without remitting sales and use tax to the state, or purchasing non-salable items from out of state vendors.

Filing and remittance — Avoid these filing errors that might increase your risk of an audit: failure to prepay where required, late payment, or payment to incorrect jurisdictions.

Product and service taxability — Neglecting to update product and service taxability as rules change, lack of updates to expanding product and service offerings.

Action Items:

- Read the Aberdeen Group’s white paper, “Strategies for Automating Tax Management.”

Sample of states that have enacted related rule changes:

New York, California

8. Know applicable sales tax holidays

There are at least 17 states with sales tax holidays in 2013. Sales tax holidays give consumers an opportunity to purchase goods and services tax-free. Ranging from school supplies in New Mexico to hurricane preparedness supplies in Louisiana, states specify the types of products that are exempt on which days, and for which customers.

By their very nature, these tax holidays can be ad-hoc and unpredictable. Varying by type of goods, or time of year, over different periods of time. And there is absolutely no consistency from state to state. It’s so haphazard, there’s little chance of getting this right consistently, which means potentially disappointing customers expecting to get a sales tax break on a purchase.

Action Items:

- If you operate a business in one or more of the following states, sales tax holidays are already in place:

Arkansas, Connecticut, Georgia, Iowa, Louisiana, Maryland, Mississippi, Missouri, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia. - Know which products and services are considered exempt and up to what value amount specified within the tax holiday rules.

Sample of states that have enacted related rule changes:

Connecticut, Texas, Maryland, Massachusetts, South Carolina, Virginia, Vermont, Oklahoma

9. Automate

In 2013, automation is the name of the game. From inventory management to sales to finance, automation gives companies the agility, flexibility, and efficiency they require in a still-recovering market. The alternative – handling these processes manually – can stymie rather than promote growth. Automation allows growing businesses to leverage limited resources of time and money without sacrificing productivity.

When handled manually, sales and use tax compliance is prone to error, and directs staff time to pass-through, rather than revenue-generating activities.

Action Items:

- Identify which manual processes have the lowest return on investments of time and money.

- Consider moving certain operations to the cloud, could lower costs as well as risk exposure.

10. Automate

Companies trying to accurately collect, file, and report sales and use taxes face an uphill battle. For most companies, automating and outsourcing their payroll management process to experts is a matter of course. The same logic applies to the much more complicated area of sales tax management.

Check out our free whitepaper, “Tax Compliance and the ERP System: How to Eliminate Error and Ensure Compliance.”

Any Accounting Manager or Controller can quickly explain how difficult tax rate tables can be to work with, especially if they meet some common criteria:

- They do business in multiple states or jurisdictions (or more than one country)

- They buy, sell, or resell multiple products or services that could be taxable at more than one rate

- They engage in a supply chain that requires the collection of sales tax, use tax, and exemption certificates

But it’s not just business complexity that makes tax rate tables difficult. Sales and use tax rates and rules are constantly changing at local, state, and federal level, which means any company who manages tax compliance manually, has to spend time researching rates and updating their tax tables.

Stop wasting time, energy, and resources on activities that don’t generate revenue.